Many of us have electronic calendars with alarms set to remind us to do this or go there…some of us still rely on a paper calendar that is carefully color-coded with each family member’s activities, appointments, and practices. We spend a lot of time planning for day to day events but often fail to plan for the unexpected. That could mean death or it could mean getting so sick you are unable to work or take care of yourself and your family.

My BMF (“best mom friend” if you missed my last blog post) recently lost a close friend who lived locally but was single and had no family in town, much less the state. When my BMF had not heard from her friend (as she usually did each morning), she got a little concerned. After several hours of not hearing from her, her suspicion was confirmed…her friend had suffered a heart attack and was dead on the bathroom floor of her home. Fortunately, my BMF happened to know her friend’s passcode for her iPhone and was able to log in to get a phone number to call her siblings and let them know what had happened. This got me thinking: what things do I need to do in case the unexpected happens to me?

1. Will, Power of Attorney, Advanced Directive for Healthcare: What kind of attorney would I be if I did not tell everyone to make sure they had a Will, Power of Attorney, and Advanced Directive for Healthcare?!? If you already have one, go you! Think about whether you need to update it and if the person you named to handle all your affairs, be your Power of Attorney, or serve as your health care proxy knows where the original is and what to do if the unexpected happens. If you don’t have one, you are not too late and you are not too young. There are lots of great lawyers who will be glad to help you with any or all of these important documents.

2. Passwords: So…most of us pay our bills online, which requires a username and password. Do you have a list of your accounts for bills and other financial accounts with username and password for each account tucked away somewhere? If not, maybe it’s time to make that list and then calendar to remind yourself to update it. Let someone you trust know where that list is located so that your affairs can be handled in case the unexpected happens.

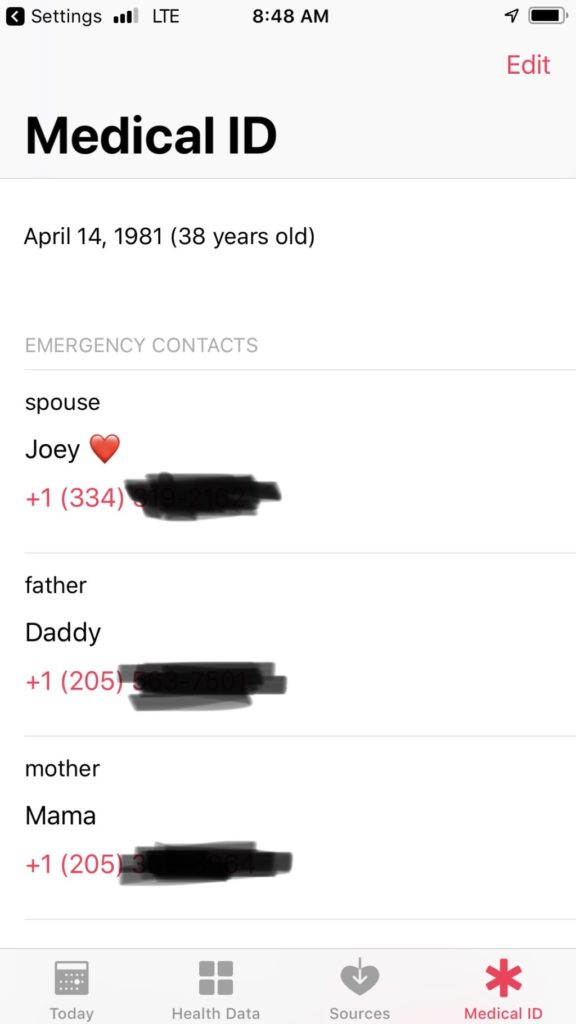

3. Phone/Emergency Contacts: There are generally two major types of phone users: iPhone and Android. I happen to hail to team iPhone and that means I have a 7 digit passcode. My 4 year old knows my passcode. If you have an iPhone, consider adding your passcode to your list of passwords so that important people can be notified if something were to happen to you. Those of you who hail to team Android…I am not really sure how you guys unlock your phones, but I have seen some of you use your finger to connect the dots like some kind of maze, so maybe draw that out for someone? Seriously, though–make sure someone you trust knows how to get in your phone. If giving someone the passcode to your phone freaks you out, I just learned that iPhone allows you to list emergency contacts that can be accessed without your passcode. Under “Settings”, choose “Emergency SOS” and then choose “Set up Emergency Contacts in Health.” Here you can create a Medical ID with information like allergies and medical conditions, whether you are an organ donor, medications you take, etc. Under the “*Medical ID” tab, you can add emergency contacts that are notified and given your location when you use Emergency SOS to call Emergency Services.

4. Natural Disasters/Weather Emergencies: After the tornado that came through and damaged so much in our area in early March, I think we are all probably more prepared for weather emergencies than we ever were before. If you don’t have a good weather app (NOT your iPhone “weather” app), consider downloading one (most are free, I love the WSFA weather app and Weather Radio app) and allow it to send you notifications. Have a plan for what to do when a weather emergency is expected and teach your kids what the plan is. Keep flashlights charged or batteries on hand, have helmets nearby, and put on closed toe shoes. Get a weather radio. If you live in a mobile home, have a plan of where to go and get there early. Do not wait until the last minute!

5. Emergency Fund: If you have ever listened to Dave Ramsey, you know that he advocates strongly for an emergency fund. Dave says if you have debt, save $1,000 as a starter emergency fund then try to grow it to be able to cover at least three to six months worth of expenses. You never know when your water heater is going to go out or your roof caves in or you get terribly sick–this fund helps cushion the blow.

6. Life & Disability Insurance: Whether you get a term or whole life policy, you need life insurance and you need to name a beneficiary of those funds so that your beneficiary can pay your debts and cover end of life expenses. Disability insurance can be long term or short term that replaces your income for a defined period of time if you experience a disability and are unable to work. If it has been a while or there have been changes in your life, you may want to check to see if you need to update your beneficiaries to your insurance. If you don’t have one or both of these types of policies, consider talking to your insurance agent about options.

Planning for the unexpected may feel scary or even silly if you are young, but it is so important for you and your loved ones. Even if this list feels difficult to tackle, you will feel better knowing you have taken care of these things to make difficult and unexpected issues a little easier for yourself and those you love.

Check out these links for more info:

https://www.daveramsey.com/blog/quick-guide-to-your-emergency-fund

https://www.statefarm.com/simple-insights/planning/the-benefits-of-disability-insurance

https://www.alabar.org/assets/2014/08/Advance-Healthcareplanning_01162012.pdf

Great advice. Some password managers like LastPass let you designate someone who can access all your accounts in the event of your death. A printed list of all your passwords is a less desirable solution imo.

Good call, Ben! Thanks!!

Comments are closed.