“You’ve got HOW much?” The real estate agent’s obvious surprise at our answer made us realize our decision to wait and save for our down payment had been a good one. We ended up not only getting the house we wanted, but setting aside some of our savings, at her suggestion, for an emergency fund. We were also able to get our monthly payments within reach of a one-income budget.

“You’ve got HOW much?” The real estate agent’s obvious surprise at our answer made us realize our decision to wait and save for our down payment had been a good one. We ended up not only getting the house we wanted, but setting aside some of our savings, at her suggestion, for an emergency fund. We were also able to get our monthly payments within reach of a one-income budget.

I told Kent when we were dating that I wanted to be a stay-at-home mom if I ever had kids. I don’t know if he didn’t hear me or just figured I’d change my mind. When it was time to return to work after my maternity leave, we had an intense discussion and he finally said, “Let’s pray about it for three days, then talk again.”

Three days later, we went out to dinner and had another discussion. He said he’d agree for me to stay home if three conditions were met. They were:

1. I would work for one more year.

2. We put all of my paycheck aside except our church tithe and childcare.

3. We had to find a house in our price range-in good condition, in a convenient location, and with a good yard.

I have a suspicion he believed the last two would never happen and he’d be off the hook. We’d been looking for a house for a long time and nothing we could afford on our two-income budget came with any of those qualifications. What he didn’t figure on was that I’d been praying and hoping for this for as long as I could remember, so I was determined to make it happen. We had already been introduced to some good financial practices in our young married class at church and the necessary changes to our spending would have to be creative, but I believed they were doable. A friend agreed to keep our daughter while we were at work, so not only would childcare be affordable, I only had to walk across the street each morning.

Kent and I both got paid once per month, so we were already used to knowing up front how much money we had to work with. That first month, after depositing my paycheck to savings, I made out a menu and we bought a small chest freezer. Anything I could buy in bulk, I did-dividing meat into meal-sized portions, labeling, and freezing them. My parents and Kent’s grandparents both had gardens every summer and shared frozen/canned vegetables with us that not only tasted wonderful, they saved us money. Eventually, we had our own garden saving even more money. We had to buy perishables like milk and bread a couple of times during the month, but in general, one big grocery trip stocked the pantry for the entire month.

We used an envelope system and set ourselves limits on entertainment and luxuries. Once the money in the envelope was gone-no more until next month. We gave up eating out except on rare occasions and learned to get creative with vacations and date nights. We organized a parent’s night out with other families at church that provided child care one Friday night each month in exchange for working two Fridays during the year. We discovered that having fun doesn’t depend on how much you have to spend.

Finally, we gave ourselves an allowance. We had actually established this a few years earlier when we realized how quickly personal hobbies can eat up expendable income, but living on one paycheck, we had to make adjustments. During our trial year, clothing purchases and eating out for lunch at work began to come out of our allowance as well. Each of us was free to decide how to spend our own allowance. The main rule was simply, “When it’s gone, it’s gone.”

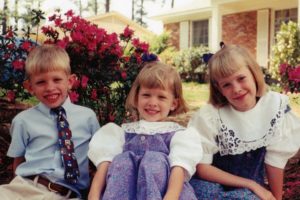

Disciplining ourselves to stay on a tight budget and working together as a team was good for us. We learned valuable lessons on setting priorities and making wise choices. We also had some productive discussions about future goals. Near the end of that year, we got a surprise call from our real estate agent telling us she’d found just the right house. Because we had saved my paycheck, we were able to make a good offer and the house was ours. When the time came that spring to declare my intent for the next year as far as my job was concerned, Kent asked, “Are you sure you want to do this?” My reply? “Absolutely,” and even though there have been times over the years when our budget has been tight for various reasons, we have always made it through and been blessed in the process. My being at home has worked for our family and I have never regretted making that choice.